ex works shipping terms revenue recognition

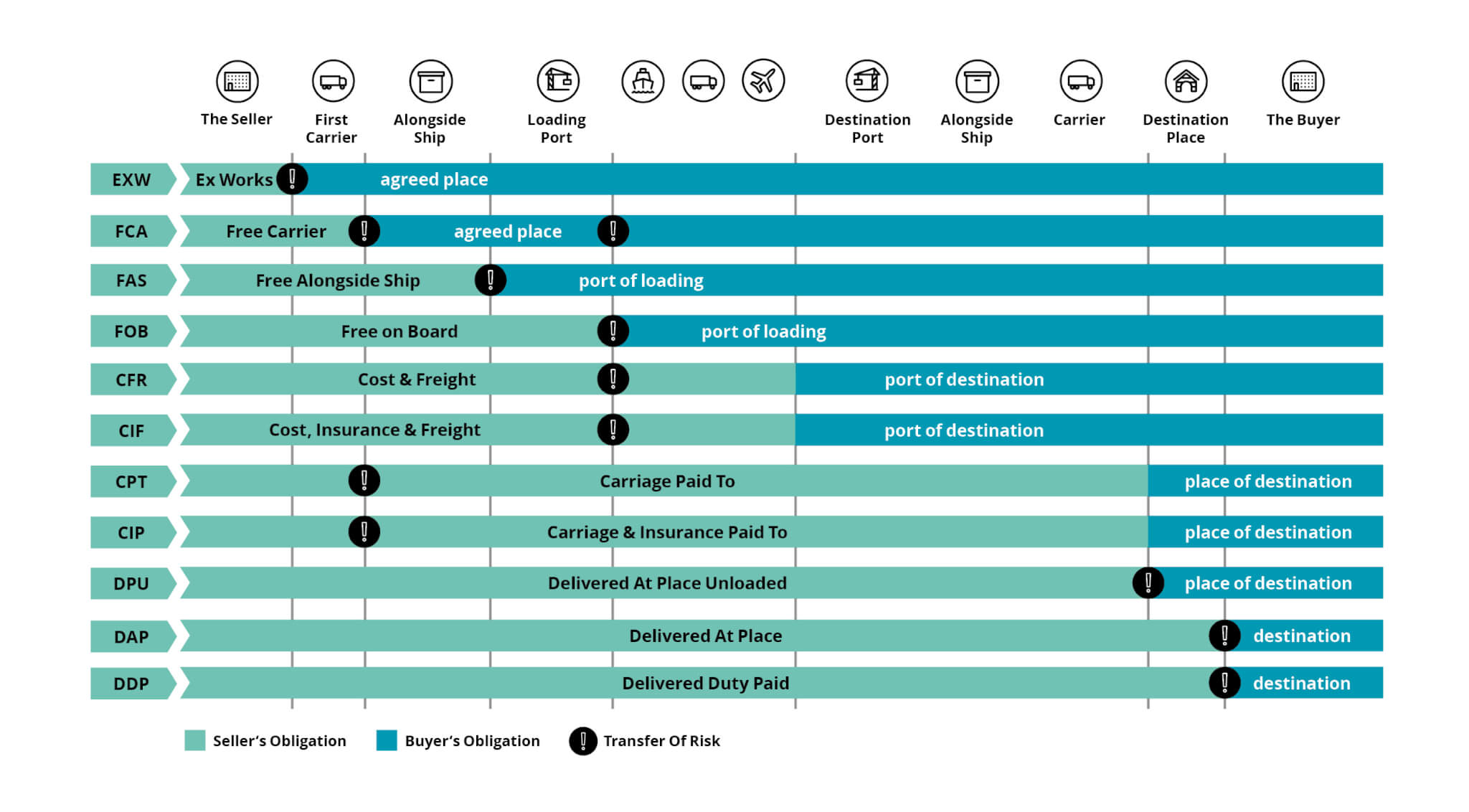

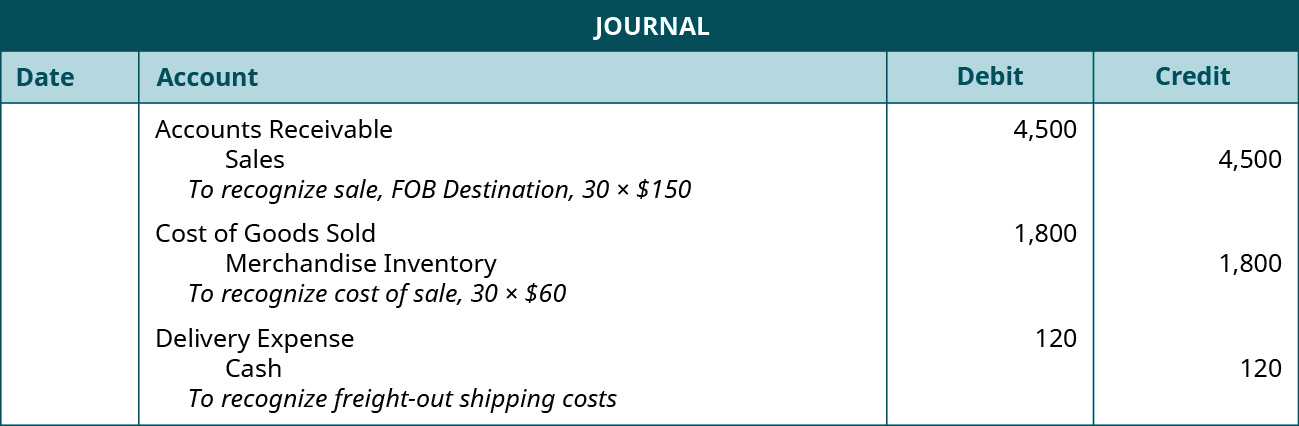

Delivery occurs when goods are placed for the buyers disposal without necessarily to be loaded. The shipping terms most commonly used in contracts between the Company and the customer for delivery of capital solar equipment are FOB Ex-Works and CIP.

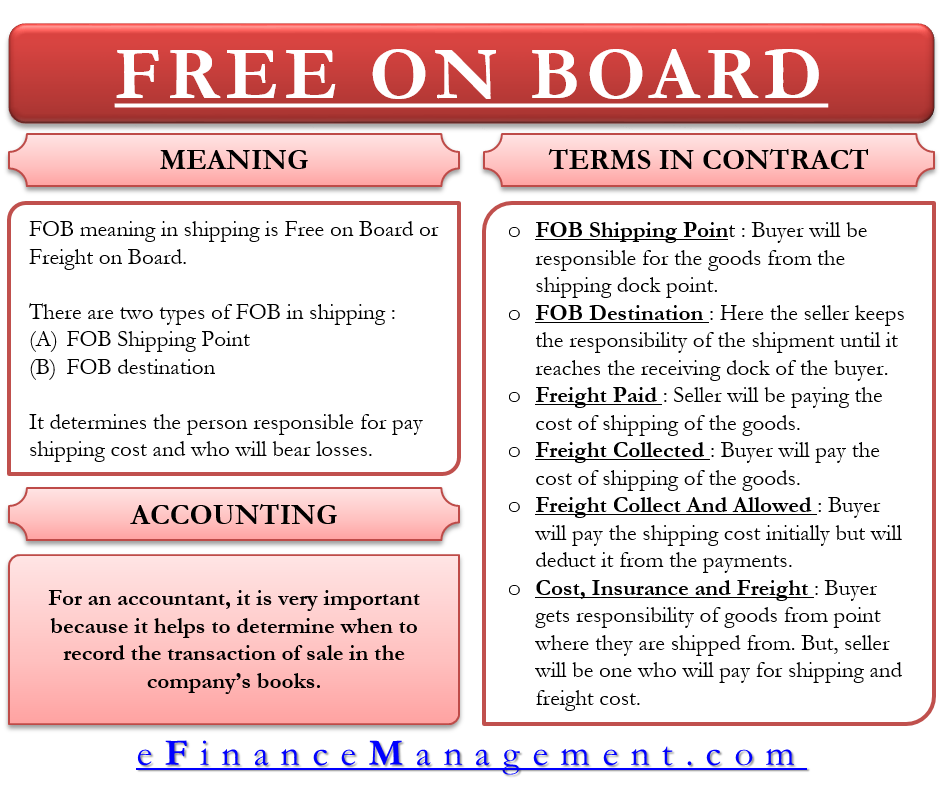

Fob Meaning With Example Efinancemanagement

The Point of Revenue recognition may change when the term of delivery is change it May be EXW Ex Work or CNF etc But the basic concept remains the same that is when the Performance obligation.

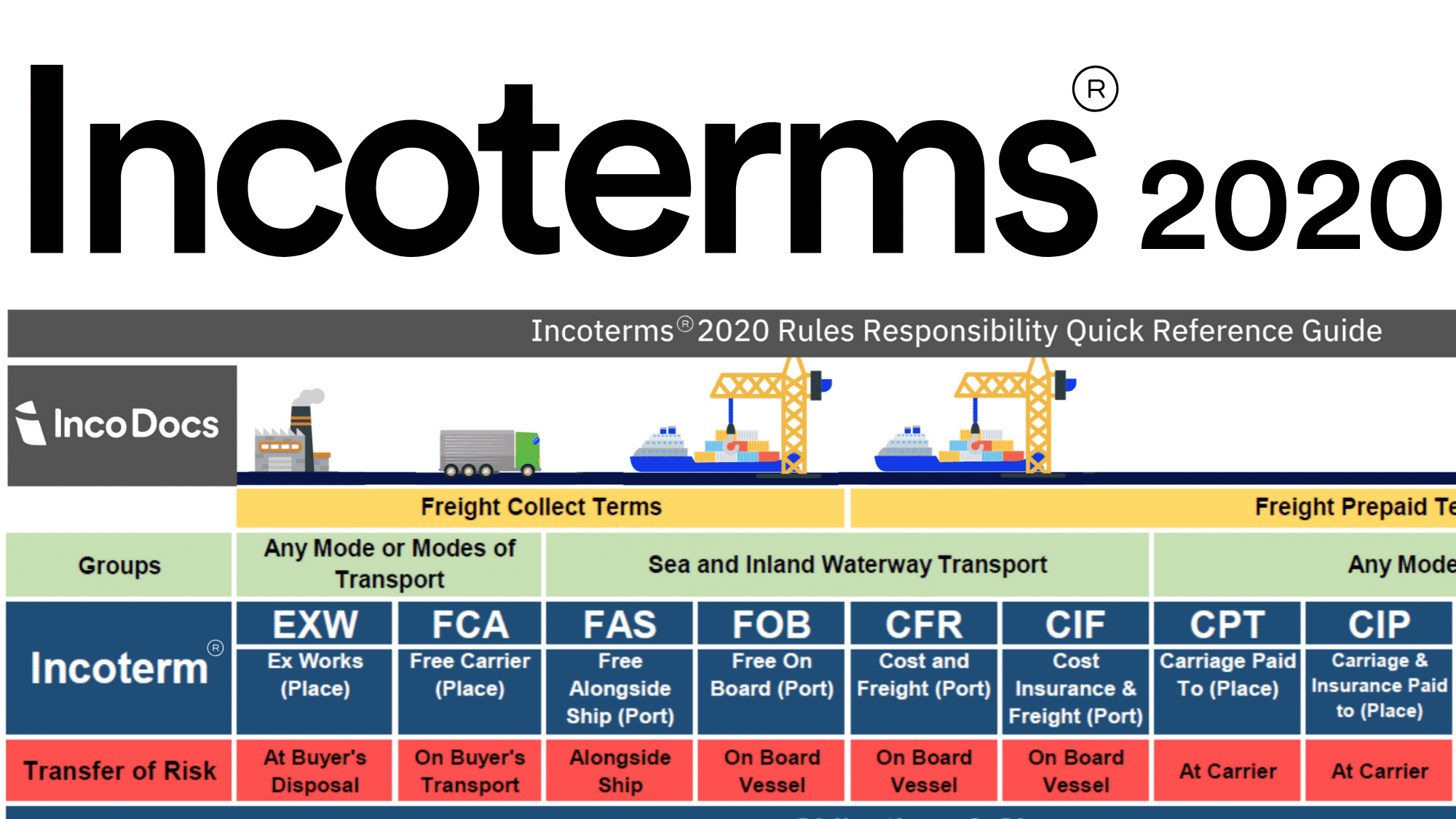

. Ex-works terms make the seller responsible to place the goods at the disposal of the buyer at the sellers facilities or any other named place. A Few Quick Points. The Incoterms 2020 Rules.

Overseas shipment and customs duty. From the sellers perspective there is the problem of obtaining evidence that the. Revenue is recognized when collectibility is reasonably assured.

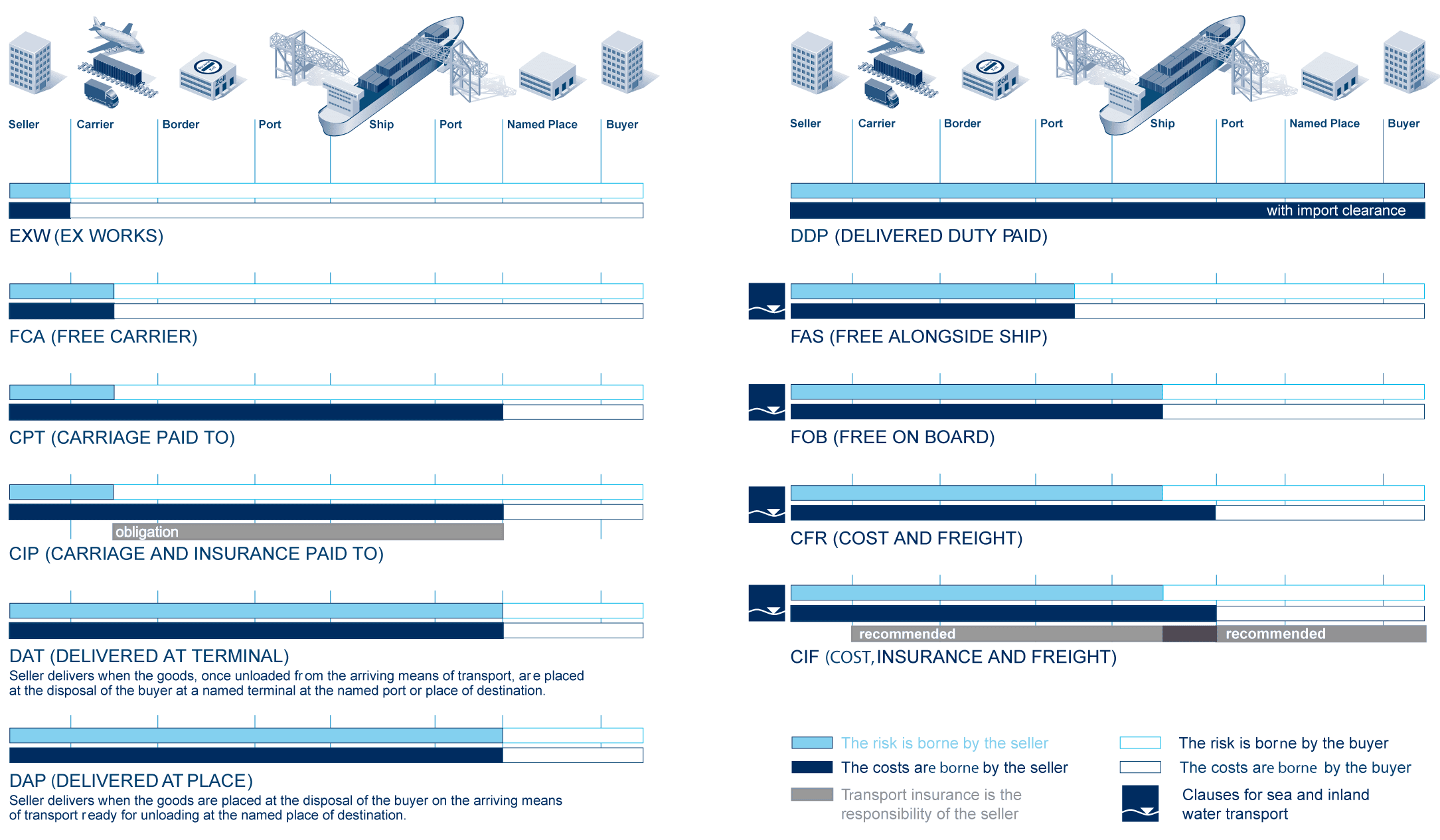

INCOTERMS 2010 E _ Terms. The EXW term is never involved with an AWB or OBL. In any event the seller is only obliged to provide assistance at the buyers risk and expense.

Major problems if used with a Letter of Credit. Ex works is the same as Freight on Board FOB Shipping. The seller is responsible for the freight and insurance if desired and title passes to the buyer only on arrival.

ASU 2016-10 was issued in April 2016 and amended ASC 606 for shipping and handling activities as follows. However Incoterms do not define revenue recognition rules. Goods are invoiced to customers on CIFCPTDDU basis Carriage Paid To Named Place or Delivered Duty Unpaid at Named Place.

Revenue recognition criteria have been met. Under these terms goods are at the sellers risk until they arrive. Buyer is not required to disclose any export information or details regarding the export of the goods.

The shipper will likely be required to present an AWB or OBL. Ex Works EXW Incoterms can be used for all modes of transport and even when there are multiple modes of transport involved in transportation. Working with a CPA who is knowledgeable with domestic and international shipping terms as well as revenue recognition standards will help raise your awareness and.

The buyer is responsible for loading the goods onto a vehicle even though the seller may be better. The named place can be other than the seller premises. Definitions of these terms in accordance with the International Commercial terms Incoterms are listed below.

This issue was brought to attention of the Transition Resource Group TRG who discussed the matter and ultimately advised for clarifying guidance to be issued. EXW Incoterms 2020. Revenue recognition shipment of goods Scenario.

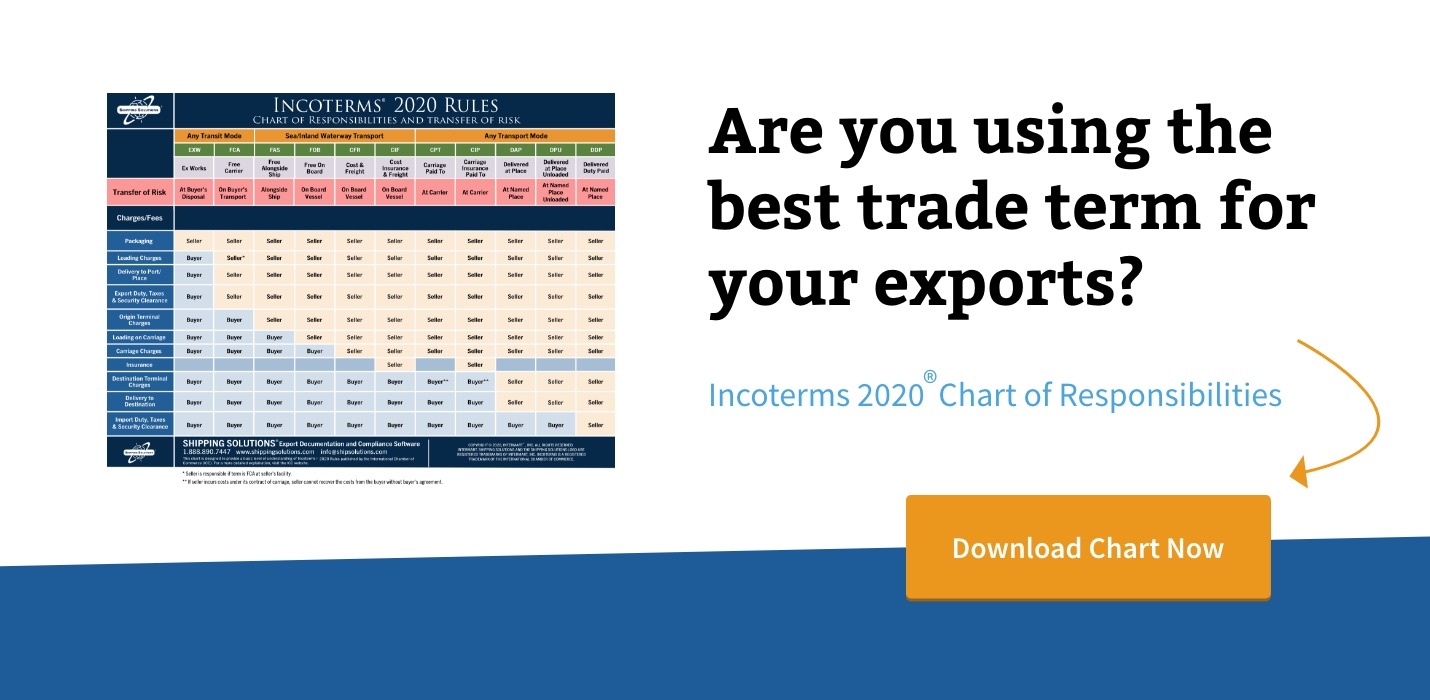

A company is required to consider the underlying substance and economics of an arrangement not merely its legal form. Some of the most common international shipping arrangements are Ex Works EXW Free Alongside Shipping FAS Cost Insurance and Freight CIF and Delivered Duty Paid DDP. INCO Term Revenue Recognition Location Trigger Document When You Can Invoice When Risk Transfers Ex-works plants loading dock Written notification to buyer that goods are ready for pick-up upon written notification of readiness to buyer once cargo is placed at loading dock and made available to buyers trucker FCA Plant cargo loaded on truck or in railcar Truck Bill of.

The reason is that the revenue is recognized when control of the goods is transferred to the customer and this moment depends on Incoterms too for example. Ex works shipping terms revenue recognition. Risk transfers from seller to buyer when the seller makes the good available at the sellers premises.

This rule places minimum responsibility on the seller who merely has to make the goods available suitably packaged at the specified place usually the sellers factory or depot. Revenue recognition page 39. EXW means Ex Works and in this case the seller makes goods available at their premises and the buyer bears the costs and risks associated with the transport of goods to the buyers place.

We were using ExWorks as a default term for all exports EU and third country unless the customer insisted on something else. The advantage of ex-works from a sellers standpoint is that the seller is allowed to recognize revenue once the product has been picked up or a contract has been signed. Management must establish that it is probable that economic benefits will flow before revenue can be recognized.

Ex Works obliges the buyer to undertake export procedures obtaining of licences security clearances and so on The buyer may be poorly placed to do this. Ex Works EXW Can be used for any transport mode or where there is more than one transport mode. The sales agreement incoterm is Ex-works - sellers premises.

For arrangements with multiple elements the company allocates total fees under contract to each element using the relative fair value method and revenue is recognized upon delivery of each element. Chart of Responsibilities and Transfer of Risk summarizes the seller. It was nonsense in my opinion especially as in more than 70 of cases our company organised and paid the international freight and sent a.

The seller does not need to then load items onto a truck or ship and the remainder of the shipment is the responsibility of the buyer eg. And according to the definition of Ex-works transportation costs and associated risks are no longer a burden for the seller. This is the best Incoterm to use if the buyer wants to handle everything for a shipment without sellers interference or support.

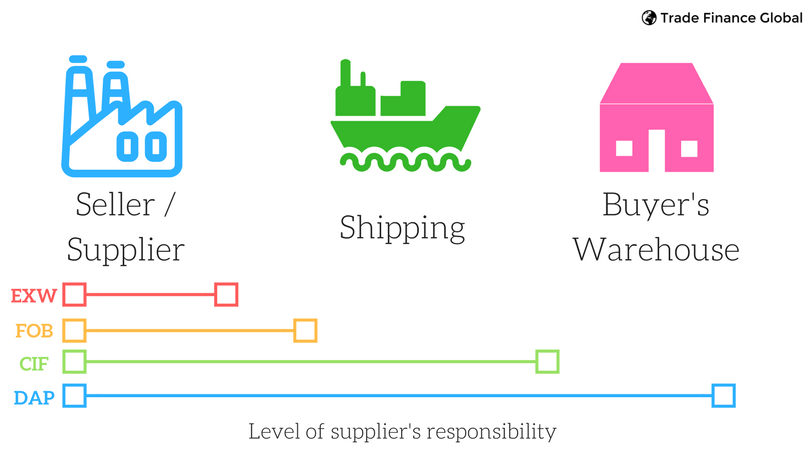

There are 11 trade terms available under the Incoterms 2020 rules that range from Ex Works EXW which conveys the least amount of responsibility and risk on the seller to Delivered Duty Paid DDP which places the most responsibility and risk on the seller. Question on revenue recognition for a month-end shipment. Ex Works EXW is the Incoterms 2020 rule used to describe the delivery of goods by the seller at their place of business normally in their factory offices or warehouse.

When EXW is used in a contract the named place is. We shipped goods to a buyer last week in December and the shipment was delivered on Jan 3rd. One of the first things I started to look at was our use of Incoterms Rules.

Ex Works EXW is an international trade term by which a seller makes the product available at a designated location and the buyer incurs transport costs. The two terms can be used interchangeably because they assume the same terms and agreement between the buyer and seller. Entities must make.

If the loading operation is performed by the seller it is difficult for the buyer to. If the customer takes control of the good before shipment. Some traders like EXW because they believe it allows them to recognize revenue at the earliest possible instance.

The Incoterm that places the most responsibility on the buyer EXW or Ex Works indicates an international trade contract in which the seller has the goods ready for pickup from an agreed on location and often the sellers factory buyer is responsible for all operations including pickup export responsibilities and all.

Delivered Duty Paid Incoterms Explained

Incoterms 2010 Comprehensive Guide For 2020 Updated

Ddu Shipping Check What Is Rule Unders Ddu Incoterms

What Are Incoterms 2020 Velotrade Guides Trade Guides

Incoterms 2020 Exw Spotlight On Ex Works Shipping Solutions

New Incoterms 2020 And Their Impact On Accounting Dreport In English

Exw Ex Works Incoterms 2020 Rule Updated 2022 Free Podcast Pdf

Incoterms 2020 Exw Spotlight On Ex Works Shipping Solutions

Incoterms 2010 Comprehensive Guide For 2020 Updated

Difference Between Ex Works And Dap In Shipping Terms

Incoterms 2020 Explained The Complete Guide Incodocs

Fob Shipping Point Meaning Example And More Financial Management Accounting And Finance Meant To Be

Discuss And Record Transactions Applying The Two Commonly Used Freight In Methods Principles Of Accounting Volume 1 Financial Accounting

Get To Know Incoterms 2020 Oceanair Inc

Incoterms 2010 Icc Official Rules For The Interpretation Of Trade Terms

Get To Know Incoterms 2020 Oceanair Inc