modified business tax refund

See What Programs You Qualify for. How you can complete the Nevada modified business tax return form on the web.

Employee Retention Credit Refund Check Status Disasterloanadvisors Com

This is the standard.

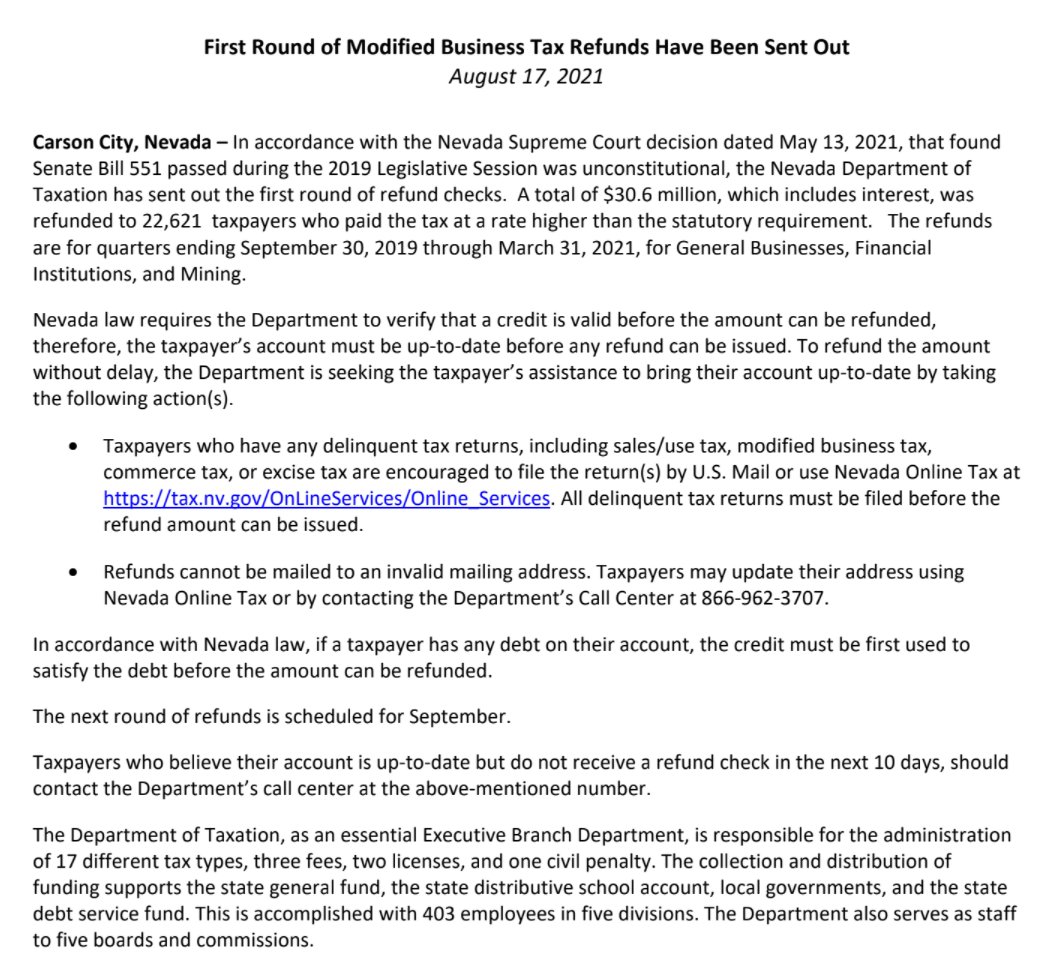

. Affordable Reliable Services. Sales Tax Refund in Piscataway NJ. On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was unconstitutional and ordered the Nevada.

This is an optional tax refund-related loan from MetaBank NA. In addition to the change to the Financial Institution definition and the. MODIFIED BUSINESS TAX RETURN TID No020-TX GENERAL BUSINESS Revised 2016 FOR DEPARTMENT USE ONLY Mail Original To.

Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. Home NJ Piscataway Tax Reporting Service Business Tax Return Preparation. NEVADA DEPARTMENT OF TAXATION P O BOX.

Free Quote Consult. Once youve found your business click on the View Details button and scroll down to the Tax ID section. To get started on the blank use the Fill camp.

A new Modified Business Tax Return MBT-Mining has been developed for this reporting purpose. See reviews photos directions phone numbers and more for Irs Tax Refund locations in Piscataway NJ. Ad Trusted BBB Member.

Call or Request Online. It is not your tax refund. Your Nevada Modified Business Tax number should be listed.

Total gross wages are the total amount of all gross wages and reported tips paid. Sign Online button or tick the preview image of the blank. Taxable wages x 2 02 the tax due.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. Approval and loan amount. The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and.

Name A - Z. Loans are offered in amounts of 250 500 750 1250 or 3500. Modified Business Tax Forms - Nevada Department of.

Learn more Form 4506-T Request for. Modified Business Tax Return-General Businesses 7-1-16 to Current.

Modified Adjusted Gross Income Under The Affordable Care Act Updated With Information For Covid 19 Policies Uc Berkeley Labor Center

1st Round Of Modified Business Tax Refunds Sent To Businesses In Nevada Pahrump Valley Times

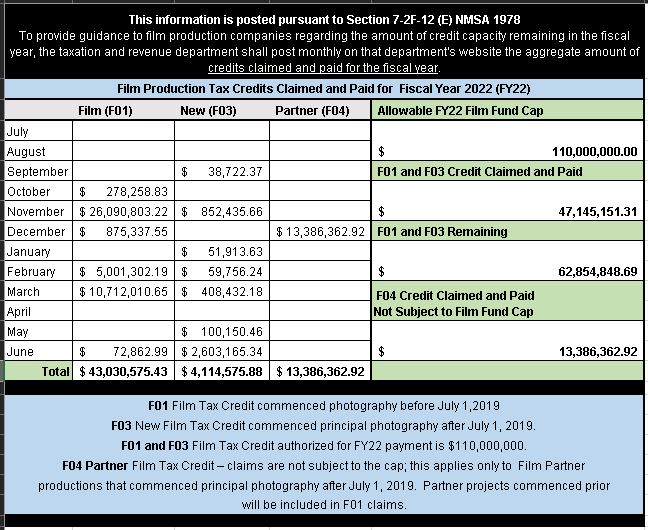

Film Production Tax Credit Tax Professionals

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

What Is A W 2 Form Turbotax Tax Tips Videos

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

:max_bytes(150000):strip_icc()/GettyImages-1131866817-af3bb858b38b4518bd77332c8c60ab66.jpg)

Tax Deductions And Credits Guide

A Guide To Changing Previously Filed Partnership Returns

Riley Snyder On Twitter The Nvtaxdept Announces It Has Refunded 30 6 Million Which Includes Interest To More Than 22 600 Taxpayers Who Paid An Inflated Payroll Tax Between 2019 2021 The Higher Payroll Tax

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

:max_bytes(150000):strip_icc()/GettyImages-176957694_journeycrop_tax_credits_deductions-2f59ca8b74d04d7ebe651a566ff04e2f-63d62615dff540cc98818863fd2583d4.jpeg)

Tax Deductions And Credits Guide

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips

Nevada Modified Business Tax Return Fill Online Printable Fillable Blank Pdffiller

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Fillable Online Modified Business Tax Return General Businesses Form Fax Email Print Pdffiller